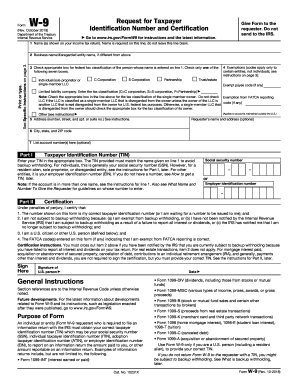

General instructions on filling out an IRS W-9. Should take most people less than 2-3 minutes. While the narration in this video speaks to Independent contractors, you may also have been asked to fill out one of these by an employer.

Sometimes when you win a prize, award, or receive some other form of value, you may be asked to provide a W-9 Simply stated, the W-9 is a required document by any entity that pays an individual (or business) an amount of money larger than $600 U.S. The purpose is so the IRS can be notified that an individual has received this value or money. And, depending on the circumstances, the IRS will expect to collect income tax on this transaction.

Irs Form W 9 For Mac

Step 2: Enter your business name or 'disregarded entity' name, if different from the name you entered for step 1. For example, you might be a sole proprietorship, but for marketing purposes, you don’t use your personal name as your business name; instead, you are “doing business as” some other name.

You would enter that name here. As for the disregarded entity part, if you don’t know what it is, you probably aren’t one. The most common type of disregarded entity is a single-member, and and are never classified as disregarded entities. Step 7: The IRS calls this section Part I, which has to make you wonder what all those steps you just completed were. Preview: men's and women's basketball set for macbook pro. Here, you must provide your business’s tax identification number, which will either be your individual if you’re a sole proprietorship, or your if you’re another type of business.

Now, some sole proprietorships also have EINs, but the IRS prefers that sole proprietors use their SSNs on form W-9. Again, doing so will make it easier to match any 1099s you receive with your tax return, which you will file under your SSN. Most taxpayers are exempt from.

Irs Form W-9 For Mac Free

If you have no idea what the IRS is talking about here, you’re probably exempt. If you aren’t exempt, the IRS will have notified you, and the company paying you needs to know because it is required to withhold from your pay at a flat rate of 28% and send it to the IRS. (Incidentally, now you know another good reason not to cheat on your tax return: You might have to tell a future client about it, and that might make the company think twice about you.) Item (c) basically says that if you were once subject to backup withholding but aren’t anymore, no one needs to know. It’s basically the same as item (a). Click to read details from the IRS on backup withholding. Return your completed W-9 to the business that asked you to fill it out.

Ideally, you’ll hand it off in person to limit your exposure to, but this method often isn’t practical. Mail is considered relatively secure. If you must email the form, you should encrypt both the document and your email message and triple check that you have the recipient’s correct email address before sending your message. Free services are available online to help you do this, but check their reputations before trusting your documents to them.